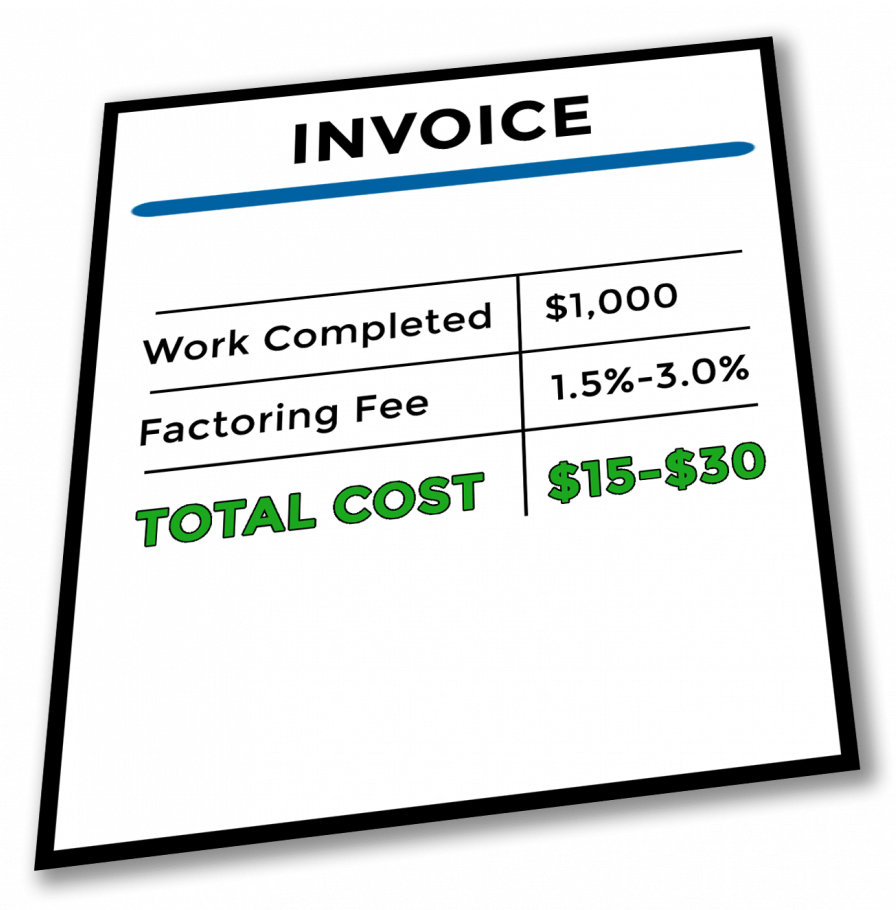

The remainder of the loan amount (minus applicable fees) after the customer has paid the outstanding invoice.The advance, which is an upfront payment of 70 to 90 percent of the invoice.Invoice factoring companies typically pay you in the following two installments: This allows you to turn your accounts receivable into cash, rather than waiting as long as 90 days for customers to pay. With invoice factoring, you get paid by a factoring company, and the factoring company then gets paid directly by your customer. Simply put, invoice factoring is when a business sells its accounts receivable to an invoice factoring company in exchange for upfront cash. Invoice factoring is a way for business owners to quickly unlock funds from pending invoices for operational expenses as well as growth opportunities. Invoice factoring is a way for small business owners to take out a loan against unpaid customer invoices–it’s typically best for businesses whose customers do not pay for goods right away but need cash on hand to run their business effectively. A common challenge many small businesses face is the delay between when invoices are paid and when new inventory needs to be purchased. While those small businesses may fall in a wide range of industries, from construction to beauty salons, they all share one thing in common - all require a steady flow of working capital. About 225,000 new small businesses are established every quarter in the United States.

0 kommentar(er)

0 kommentar(er)